Dental Insurance Market: Trends in Oral Healthcare Coverage and Consumer Preferences

Dental Insurance Market: Trends in Oral Healthcare Coverage and Consumer Preferences

Blog Article

"Dental Insurance Market Size And Forecast by 2031

A comprehensive research report on the Dental Insurance Market offers detailed insights into its size, share, and revenue trends. It highlights growth drivers, challenges, and future opportunities, making it an essential resource for companies seeking to stay ahead in the market. Leaders that leverage these insights and align with industry trends are poised to achieve sustained success in the evolving keyword Market.

The Dental Insurance Market continues to gain traction as a key player in the global economy, presenting substantial opportunities for businesses worldwide. Recent industry statistics underscore a significant rise in market size, with projections indicating sustained growth drivers over the coming years. Companies across sectors are leveraging this momentum to secure a greater share of the competitive landscape.

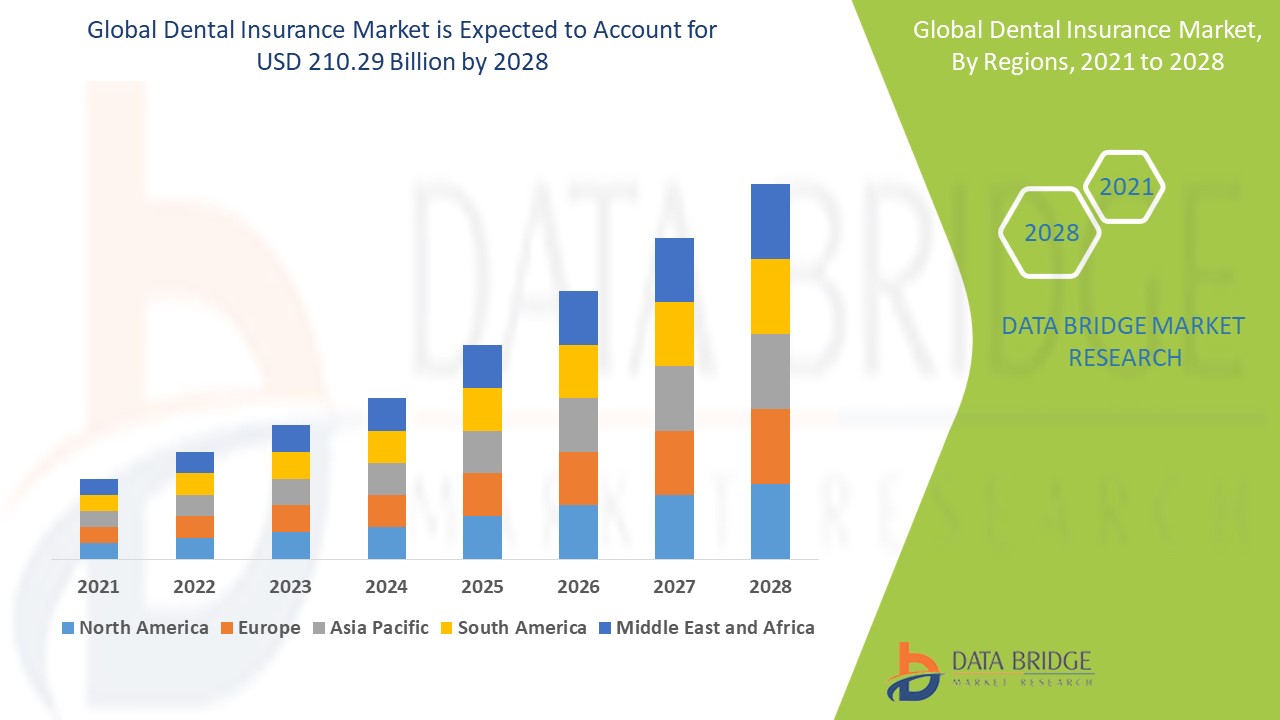

The global dental insurance market size was valued at USD 172.94 billion in 2024 and is projected to reach USD 255.70 billion by 2032, with a CAGR of 5.01% during the forecast period of 2025 to 2032.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-dental-insurance-market

Which are the top companies operating in the Dental Insurance Market?

The global Dental Insurance Market study presents a detailed analysis of the industry, focusing on key trends, market dynamics, and the competitive landscape. It highlights leading companies in the market, examining their strategies and contributions to market share. Additionally, the report offers insights into the Top 10 Companies in Dental Insurance Market in the Dental Insurance Market, including their business strategies, financial performance, and overall market position.

**Segments**

- **Insurance Type:** Dental insurance can be segmented into two main types - individual plans and group plans. Individual plans are purchased by individuals to cover their dental expenses, while group plans are typically offered by employers or organizations to their members.

- **Coverage Type:** Dental insurance coverage can vary based on the type of services covered. Basic coverage includes routine check-ups, cleanings, and X-rays, while comprehensive coverage may include major dental procedures such as root canals, crowns, and orthodontic treatments.

- **Demographics:** The demand for dental insurance is influenced by demographics such as age, income level, and geographic location. Older individuals and those with higher incomes are more likely to invest in dental insurance due to their higher dental care needs and financial capacity.

**Market Players**

- **Some of the key players operating in the global dental insurance market include:**

1. Delta Dental

2. UnitedHealthcare

3. MetLife

4. Cigna

5. Humana

6. Aetna

7. Guardian Life

8. Ameritas

9. Sun Life Financial

10. Allstate Insurance Company

The global dental insurance market is witnessing steady growth due to the increasing awareness about oral health, rising dental care costs, and the availability of a wide range of dental insurance products to cater to diverse consumer needs. Companies are focusing on expanding their coverage options, enhancing customer service, and leveraging digital technologies to streamline the insurance process. With the growing emphasis on preventive dental care and the rising prevalence of dental disorders globally, the demand for dental insurance is expected to rise in the coming years.

The insurance type segment is crucial in determining the extent of coverage an individual or group can avail. Individual plans are popular among self-employed individuals or those without employer-sponsored coverage, providing them with the flexibility to select a plan based on their specific needs.The dental insurance market is characterized by its segmentation into various categories that cater to different consumer needs. The insurance type segmentation into individual plans and group plans offers flexibility and choice to individuals and organizations seeking coverage for dental services. Individual plans allow for personalized coverage selection tailored to individual requirements, often chosen by self-employed individuals or those without employer-sponsored options. On the other hand, group plans are typically provided by employers or organizations as part of employee benefits packages, ensuring access to dental care for a larger group at potentially lower costs.

When it comes to coverage types, the segmentation distinguishes between basic coverage and comprehensive coverage. Basic coverage includes essential preventive services like regular check-ups, cleanings, and X-rays, which are crucial for maintaining good oral health. In contrast, comprehensive coverage encompasses a wider range of services, including major procedures such as root canals, crowns, and orthodontic treatments. This segmentation allows consumers to choose the level of coverage that best suits their needs and budget, ensuring they have access to the dental services they require.

Demographics play a significant role in shaping the demand for dental insurance. Factors such as age, income level, and geographic location can influence an individual's likelihood of purchasing dental insurance. Older individuals often require more frequent dental care, making them more inclined to invest in insurance that helps cover these costs. Similarly, individuals with higher incomes may prioritize dental health and have the financial means to afford insurance coverage. Geographic location can also impact demand, with areas facing higher dental care costs or limited access to services driving higher demand for insurance coverage.

Key players in the global dental insurance market play a crucial role in driving market growth and innovation. Companies like Delta Dental, UnitedHealthcare, MetLife, and Cigna have established strong market presence and offer a diverse range of insurance products to meet consumer needs. These players focus on expanding coverage options, improving customer service, and embracing digital technologies to enhance the insurance experience for their customers. As the market continues to evolve, competition among these**Market Players**

**Aetna Inc (U.S.)

Allianz (Germany)

AFLAC INCORPORATED (U.S.)

AXA (France)

Ameritas Mutual Holding Company (U.S.)

Delta Dental Plans Association (U.S.)

Cigna Healthcare (U.S.)

MetLife Services and Solutions, LLC (U.S.)

HDFC ERGO General Insurance Company Limited (India)

Humana (U.S.)

United HealthCare Services, Inc (U.S.)**

The global dental insurance market is a dynamic sector witnessing substantial growth and evolution driven by various factors. The increasing awareness about oral health and the rising costs associated with dental care services have fueled the demand for dental insurance products globally. This demand is further amplified by the availability of a wide array of dental insurance options that cater to diverse consumer needs and preferences. Market players such as Delta Dental, UnitedHealthcare, MetLife, Cigna, and Humana are at the forefront of this industry, offering innovative insurance products, expanding coverage options, and enhancing customer service experiences.

The segmentation of the dental insurance market into insurance types, coverage types, and demographics allows for a more targeted approach in meeting consumer requirements. Individual plans cater to the needs of self-employed individuals and those without employer-sponsored coverage, providing them with flexibility and personalized options. Group plans, on the other hand, are designed to meet the dental care needs of a larger group, typically offered by employers or organizations. The coverage type segmentation ensures that

Explore Further Details about This Research Dental Insurance Market Report https://www.databridgemarketresearch.com/reports/global-dental-insurance-market

Why B2B Companies Worldwide Choose Us for Revenue Growth and Sustainability

- Gain a clear understanding of the Dental Insurance Market, its operations, and stages in the value chain.

- Explore the current market scenario and assess future growth potential throughout the forecast period.

- Strategize effectively for marketing, market entry, expansion, and business plans by analyzing growth factors and buyer behavior.

- Stay ahead of competitors by studying their business models, strategies, and prospects.

- Make data-driven decisions with access to comprehensive primary and secondary research.

Key Insights from the Global Global Dental Insurance Market :

- Comprehensive Market Overview: A detailed examination of the global Dental Insurance Market.

- Industry Trends and Projections: Analysis of historical data (2015 onward) and future growth forecasts, including compound annual growth rates (CAGRs).

- Emerging Opportunities: Identification of new market prospects and targeted marketing strategies.

- Focus on R&D: Insights into demand for new product launches and innovative applications.

- Leading Player Profiles: Detailed profiles of major market participants.

- Market Composition: Analysis of dynamic molecule types, targets, and key resources.

- Revenue Growth: Examination of global market revenue, segmented by key players and product categories.

- Commercial Opportunities: Analysis of sales trends, licensing deals, and co-development opportunities.

Regional Insights and Language Accessibility

- North America: United States, copyright, Mexico

- Europe: Germany, France, UK, Russia, Italy

- Asia-Pacific: China, Japan, Korea, India, Southeast Asia

- South America: Brazil, Argentina, Colombia, and others

- Middle East and Africa: Saudi Arabia, UAE, Egypt, Nigeria, South Africa

Understanding market trends at a regional level is crucial for effective decision-making. Our reports cater to diverse audiences by offering localized analyses in multiple regional languages. These reports provide tailored insights for specific regions, enabling businesses and stakeholders to access relevant information for informed strategies. By bridging communication gaps, we empower regional markets to thrive and grow. Access our reports in your preferred language for a personalized understanding of industry dynamics.

Japanese : https://www.databridgemarketresearch.com/jp/reports/global-dental-insurance-market

Chinese : https://www.databridgemarketresearch.com/zh/reports/global-dental-insurance-market

Arabic : https://www.databridgemarketresearch.com/ar/reports/global-dental-insurance-market

Portuguese : https://www.databridgemarketresearch.com/pt/reports/global-dental-insurance-market

German : https://www.databridgemarketresearch.com/de/reports/global-dental-insurance-market

French : https://www.databridgemarketresearch.com/fr/reports/global-dental-insurance-market

Spanish : https://www.databridgemarketresearch.com/es/reports/global-dental-insurance-market

Korean : https://www.databridgemarketresearch.com/ko/reports/global-dental-insurance-market

Russian : https://www.databridgemarketresearch.com/ru/reports/global-dental-insurance-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]" Report this page